ALERT: JAPAN ECONOMY CONTRACTS 3.5% SIGNALING MORE TROUBLE IN ASIA

| Contract | Month | Last | Change | BIAS | Comment |

| Crude Oil | December | 85.25 | -.22 | Lower | Break of $85.00 targets summer lows. |

| Natural Gas | December | 3.482 | -.021 | Neutral | Prices range-bound between 3.3555 and 3.92. |

| S&P 500 | December | 1379.00 | 3.25 | Lower | Break of 1400 opens path for test of recent lows. |

| EUR/USD | December | 1.2728 | .0012 | Lower | Push below 1.2800 opens way to 1.2600 |

Macro View

Markets are relatively quiet on this Veteran’s Day. This is despite a report showing that Japan’s GDP contracted 3.5% in Q3. One reason is the chill in relations with China as the two put their military and nationalistic pride on the line over the sovereignty of several uninhabited islands in the China Sea. This situation does score one for those who remain concerned about China’s ownership of U.S. debt. Obviously, the Chinese are willing to turn the economic screws, in order to advance their position, but their percentage ownership has been declining, so it is less and less of a concern. We note, however, that this tiff is a potential black swan for the markets next year. Armed conflict would hit a key demand center for the global economy, meaning commodities, in particular, would sell-off if the battle got heated much the way oil spikes higher when the Middle East production center experiences upset. That calculus may be changing over the next several years, though. According to the IEA, the United States is poised to overtake Saudi Arabia, in terms of total oil production by 2020. The 1973 oil embargo will seem like ancient history by then, as a result. The opening salvos in the fiscal cliff negotiations were civil enough. The meeting among leaders this week will be telling. The most intriguing aspect will be if leaders move to let the Bush-era tax cuts expire, allowing all members to then cut taxes next year and run forever on a platform that shows that they are all tax-cutters at heart. We hope they know that the markets will be watching – punishment and reward await. The guns fell silent in the war to end all wars in Europe yesterday in 1918. If you see a veteran today, be sure to thank him or her for your freedom.

Crude Oil Market

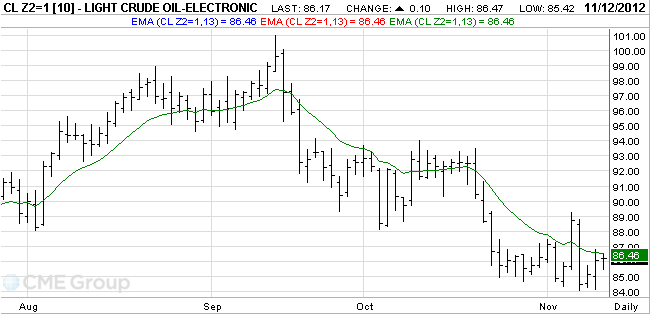

December crude oil prices reversed again to the upside on Friday. Negative sentiment over Europe’s fiscal machinations, particularly in Greece, and the US fiscal cliff, initially pushed prices lower. Statements throughout the day by the US political leadership appeared to strike a conciliatory note and consumer sentiment readings that climbed to a new five year high helped crude oil prices rally toward the 87.00 level. Deteriorating conditions in Syria added to the firm tone. But the condition of the global economy cant not be ignored. Austerity will be of only marginal utility in the diminution of sovereign debt, while seriously hampering aggregate demand for consumer oriented and export-driven economies alike. This can only weigh on oil prices in the short and intermediate term. OPEC’s recent demand revisions speak directly to this phenomenon, even though global surplus capacity, currently remains relatively tight by historical standards.

Crude Oil Tech Talk

Price action surged to the upside settling at the expected resistance 86.10, where it maintains stability below the resistance, keeping our expectations for a bearish move intact. Targets are at 84.50 then 82.00, provided that oil returns to stabilize below 86.10, whereas breaching that level and stabilizing above it will shift the intraday bias to the upside to retest 87.70, and could extend to 88.60. The trading range for this week is expected between the key support at 80.00 and the the key resistance 86.10. However significant support should be found near 78.00. If significant momentum carries past last Tuesday’s high of 89.22, it may signal a temporary bottom has been installed, and a test of channel resistance may be underway.

Natural Gas Market

As the week commences gas prices are heading towards the lower end of the consolidation, despite EIA data showing that total demand rose 7% during the week ended November 7 compared to the previous week. The surge was led by a 23% increase in residential and commercial consumption. Nevertheless, storage increased to 3.929 Tcf, the highest since the EIA began keeping records. Seasonality should hold prices within, but once 2012 expires, market participants will focus more and more on season-end totals. So this is the moment for upward pressure. If it passes consequent to another mild winter, then the same pressures that exerted themselves last Spring, driving prices to historic lows, will reappear. While the thermometer may push up into the 70s today, by week’s end it will be falling again. Still, it will have to fall quite a ways to make a significant dent in current supplies.

Natural Gas Tech Talk

Price action has breached 3.50, but key support at 3.355 remains inviolate. As long as that remains the case, bias will stay neutral. Resistance is 3.68 and a close over this would open the way for 3.77 and potentially a test of key resistance at 3.92 or higher. A convincing break of either side though could carry a long way and momentum will be a function of how long this kinetic energy has been restrained. So, an upside breakout might carry past 4.00, a break of initial support at 3.355 might presage a test of 3. 00 and break down further to 2.57. momentum that carries past 4.00 could extend to 4.983.

Michael Fitzpatrick

Editor-in-Chief

[email protected]