ALERT: ELECTIONS ACROSS EUROPE THREATEN THE ZONE

| Contract | Month | Last | Change | BIAS | Comment |

| Crude Oil | June | 97.89 | -.61 | Lower | Clear sentiment shift due to jobs data. |

| Natural Gas | June | 2.343 | .065 | Higher | Support holding, bottom may be in place. |

| S&P 500 | June | 1356.75 | -5.75 | Neutral | 1400 not seen holding. |

| EUR/USD | June | 1.3034 | -.0055 | Neutral | Euro on last legs. |

Macro View

French voters said au revoir to President Sarkozy, as expected. And seeing an opening, Greek voters pushed back against austerity throwing the tortious plans for their fiscal recovery into question. The euro quickly broke $1.30, but has recovered. Similarly, equity futures swooned, as did crude oil. Gold remained relatively steady, but is under $1650 an ounce. The early money line has not much changing, in regards to the euro zones fiscal plan. Politics being the universal the language, there is already a face saving plan emerging for the new French President and Angela Merkel. The strictures on budgets will remain (for Merkel) but there will be more use of the various rescue funds that have been under used (for Hollande). The net effect: not much. The breakdown in crude oil prices has been a long time coming. The Iran premium has dissipated. The next round of meetings occurs in two weeks’ time, and the sentiment could change in the turn of a phrase. For now, the disappointing US employment report and the emerging vulnerability of the euro and concomitant rise and the dollar disfavors commodities, and equities to a lesser degree.

Crude Oil Market

Oh, what a night! After an opening gap lower of .44 cents, the market proceeded to shed $3.15 off Friday’s settlement, and posted volume usually not seen until a few hours into the European session. The natural assumption would be that Friday’s anemic US employment situation, coupled with European electoral machinations, gave rise to enough uncertainty to spook participants out of the market or into short positions. About the same time that Hollande was high-fiving himself in the Place de la Bastille, the market was staging a dramatic turnaround that has retaken most of the night’s losses. Certainly the drop was reflective of the uncertainty connected with the electoral results. Perhaps the subsequent buying expresses the hope that European economic policy will be more stimulative. Nevertheless it is bound to confound everyone. What is not in doubt is that hard won agreements holding the Union, and single currency together with chewing gum and baling wire are going to come apart. Possibly before the year is out as social and political disintegration proceeds apace.

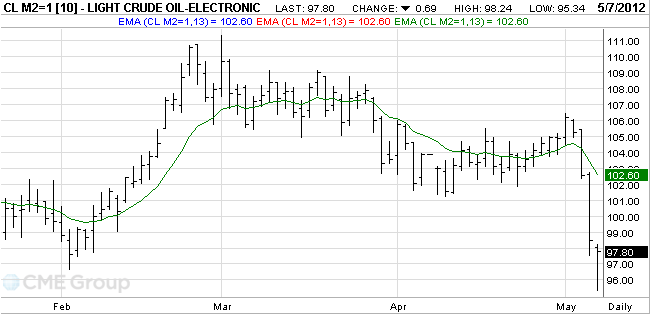

Crude Oil Tech Talk

Wednesday and Thursday represent a clear repudiation of Tuesday’s rally. Last night’s $3.00 retreat is more of the same. Clearly, the move was overdone and recovery to within .15 cents of the session high by this morning shows the market still possesses considerable inherent strength. Support may be found at 92.75 which is the 50% retracement of the 74.95 to 100.55 move. A breach there may produce a steep decline to the 74.95 low from last year and possibly below. The way today is playing out there is a strong possibility that a new low and higher settlement could be produced which may, in turn, lead to a test of 106.43, the point from which this leg commenced. With prices so far under 13-day MA though, bias stays for lower.

Natural Gas Market

The tentative recovery off recent lows is not a function of a significant shift in the underlying fundamentals that drove prices lower. It is, rather a consequence of fuel switching by utilities to cheaper gas and some very early signs that production is being cut. Coal to gas switching becomes economically obviated once the market gets to 2.50, if coal remains static. Producers must announce more substantial cuts than they have so far. The ability of perception to carry a market is limited. Unless or until that actually occurs, the current move will continue to be viewed as only a correction. A smaller than expected injection of 28bcf found more shorts retiring and pressuring prices to 2.38 before falling back. Further upward momentum though, will be difficult with storage totals crowding 3Tcf. A helpful sign came from the Baker Hughes data, which showed a decrease of 7 rigs deployed to the Nat Gas sector. With this week’s decrease the total Nat Gas rig count is hovering at the lowest level since April of 2002.

Natural Gas Tech Talk

ResNatural gas’s rebound extended further to as high as 2.385 before turning sideways. It would not be unusual to see some consolidation here as the bounce off the lows seeks further confirmation from subsequent momentum or the lack thereof. A downside move should be contained by 2.15 minor support and bring another wave of buying. rise. Above 2.385 should extend the rebound from 1.902 to 2.742 resistance and above. Otherwise, extended selling that carries below that mark will turn bias back to the downside for retest of the 1.902 low. Another down trend extension could push to the 1999 low of 1.62.Resistance should begin to gather near Tuesday’s high of 2.385 and remains problematic. Still, the opportunities look to be more abundant on dips now than rallies. And until 2,15 is breached the bias stays for higher.

Michael Fitzpatrick

Editor-in-Chief

[email protected]