ALERT: SPR, IRAN, SPAIN – WHICH PULL WILL GET PUSHED?

| Contract | Month | Last | Change | BIAS | Comment |

| Crude Oil | May | 103.20 | .42 | Lower | Possible SPRrelease breaks key support. |

| Natural Gas | May | 2.153 | -.020 | Lower | New lows open path to sub-$2.00. |

| S&P 500 | June | 1404.75 | 6.25 | Neutral | Resisitnace making 1400 difficult to hold. |

| EUR/USD | June | 1.3341 | .0049 | Neutral | Spain the latest worry. |

Macro View

The latest euro zone fix consisting of $800 billion in rescue funds seems to have spared the equity market its concern over Spain and the other basket cases. To its credit or dismay, depending on your view, the Spanish have set off down the road of austerity. The proposed budget is the harshest since it went democratic in 1978. Everything is higher this morning, as a result, except the dollar. Most notably, on the currency front, the British pound has quietly crept above $1.60, and the euro looks to be taking a run at 1.34 or higher. The dollar is under renewed pressure, due to Fed Chairman’s Bernanke’s hint at QE3 last week, but there is hardly unanimity regarding more easing. Richmond Fed President Lacker was on CNBC this morning pressing his case for no additional easing and a withdrawal of the commitment to low rates through 2013. Maybe Beranke and Lacker should swap staff economists for a week to see who needs the reality check. Obviously, as we have noted here, the US economic data series has shown improvement, but Bernanke’s entire thesis is that a failing of the Depression was a premature withdrawal of monetary easing. It looks like he is committed to not repeating that error almost to a fault. Since he is the Chairman, it is his party, and he can ease if he wants to. That should continue to weigh on the dollar, and lift equities, commodities, and precious metals. In particular, the demise of the gold rally may be a premature conclusion. If oil was not already elevated, it, too, would be supported, but a higher floor for prices is now likely, which we put, for now, the low 90s.

Crude Oil Market

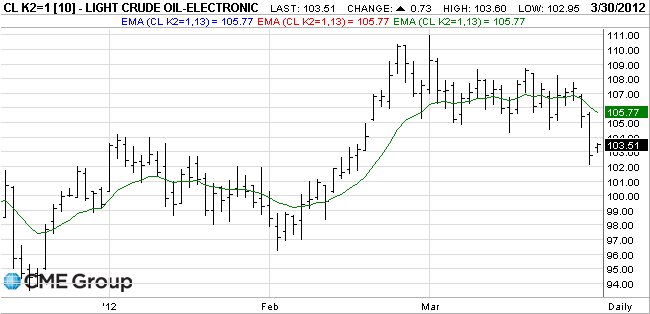

Selling momentum gathered behind the idea of a coordinated release of strategic reserves. Falling for the third consecutive session, momentum easily carried through an important technical milestone, as well. The entire month’s gains were erased as prices carried down to 102.13, a level not seen since mid-February. Adding to the selling pressure was a higher-than-expected number of new unemployment claims. Traders must also have been tempted to book month and quarter-end gains before they disappeared. Crude oil prices have advanced considerably this year as participants focused on the impact on Iranian supplies from sanctions. Additionally, an accident in the North Sea and reported attacks on oil-producing areas in South Sudan this week have supported. But a plan to tap reserves in the US, UK and France and possibly including South Korea and Japan, advanced the idea’s immediacy and could not be ignored. Some members of the IEA have argued against the need for another coordinated effort by the agency, although it said in a statement it was ready to respond if market conditions warrant action. But beware! The next provocative comment from the mullahs could quickly reverse yesterday’s assumptions.

Crude Oil Tech Talk

Now that major support at the 103.75-90 level has been meaningfully broken, the bias shifts for lower. The next test will come at the psychological barrier of 100.00. If traders can successfully break through 95.44 support it will indicate that correction pattern from last Spring’s high of 114.83 is going to extend further with another falling leg to 74.95 and below before completion. But a reversal that causes a settlement back above 104.00 will require another re-evaluation, and possibly usher in a move back into consolidation or a test of 114.83 which will target 125.40. Watch open interest carefully. Through Wednesday, it has been slowly falling, if that accelerates, length is being closed. If however, open interest expands as prices fall, it will suggest shorts are beginning to dominate.

Natural Gas Market

Gas keeps pushing lower into fresh territory. An unexpectedly high, and early, injection into already brimming stocks of 57bcf, brought the total to 2.437Tcf. The build, the second of 2012, was the largest ever for March. Moreover, EIA also reported output in January had climbed to a record, which only added to the selling pressure. After posting fresh lows for three straight sessions, more downside and an eventual $1.00 handle looks inevitable, particularly over the next several weeks, before cooling load begins to rise. However, every tic lower brings closer the market’s bottom, which certainly must be approaching. The Baker Hughes rig count has dropped for 11 straight weeks to a 10-year low of 652, and has stirred expectations that low prices would finally force producers to slow output. But the drop has yet to be reflected in pipeline flows, which are still estimated to be at or near record levels, primarily a consequence of rising output from shale.

Natural Gas Tech Talk

The downward bias was reaffirmed by another new low. A breach of the 2.13 target opens the way to an assault on 2.00, possibly even today. If that occurs, beware of an approaching blow-off bottom. Remember, markets usually overshoot, so on such a surge selling may push through to 1.95 or even lower. A reversal would necessitate a settlement over 2.393 which will suggest a bottom is in place. In such case, a stronger rebound could be seen back to 2.844 resistance and possibly above as stops are triggered, off which, a subsequent surge may produce enough momentum to commence a sustaining rally that could carry to the late February highs above 2.90. Such a move would ultimately target congestion in the 3.10-3.20 area. The probability of this is very low and more downside should be expected. But movement into new territory is always difficult. Aberrations may also be expected on the last day of the month and quarter.

Michael Fitzpatrick

Editor-in-Chief

[email protected]