ALERT: OIL PRICES IGNORE CYPRUS ANGST RALLYING FURTHER

| Contract | Month | Last | Change | BIAS | Comment |

| Crude Oil | May | 95.48 | .68 | Higher | WTI supported by US economic data. |

| Natural Gas | May | 3.901 | .013 | Neutral | Rally falters and may be over. |

| S&P 500 | June | 1550.15 | 3.15 | Higher | New record to beget new records. |

| EUR/USD | May | 1.2861 | .0009 | Lower | Euro zone does not stop producing crisis. |

Macro View

Bailout regret gripped the markets, yesterday, not long after the New York opening bell kicked off. We had thought that ship had sailed, and the all-clear sounded in regards to the Cyprus cram-down, which is also being termed a bail-in. The reality of the losses for senior bondholders and depositors is harsh, but this has been the call from many who bemoan “too big to fail.” The hit to depositors will only serve to further undermine faith in euro zone banks. Given everything the global economy has endured, the numbers involved here were small potatoes. It would have been better to spare the depositors, and the euro felt the brunt of this realization in the sober light of day. After retaking $1.30, the euro plunged, as did the major equities markets. Comments from Russia’s President Putin lit up the wires all morning. Certain of Cyprus’ leaders are openly flirting with a euro exit, even after all that has transpired. The markets have recovered, somewhat, this morning, but the euro is still below $1.30, recovering from nearly breaking $1.28. The optimism this morning is from the island of prosperity, the United States. Data from the US housing sector and solid durable goods purchases should restore the rally mode. The recovery in the US is real, as the euro zone lags, even as the euro zone acts more brutally capitalistic than the US. Depositors here are fairly sacrosanct, and it will be interesting to see where the “offshore” Cyprus funds flow now. The banks there re-open on Thursday, which may result in more tumult. The US equity rally is not over; hopefully, you bought the dip.

Crude Oil Market

WTI oil prices continue to be the shining star of the energy complex, and it has been a long time coming. The Brent-WTI spread narrowed to within $13. Oil prices ignored the Cyprus tumult and rallied. The recovering US economy is the key to this support. More gains are in store, today, as durable goods orders and data on the state of the US housing market should evidence even more improvement for the Colonial Eagle economy – that’s our “Asia Tiger” equivalent for the US. The weekly jobless claims report on Thursday should finish off a strong week for oil. Friday, the markets are closed, and Europe takes Monday, as well. The Saudi oil minister helped stabilize prices by embracing $100 per barrel as a good price. That level has certainly crept up over the years. Given the rapidity of their recent production cutback, they appear to be serious this time. In case you missed it, the EIA forecasted that US may import less than half its oil requirement later this year. As more and more people wake to this fact and wonder about continuing high gasoline prices, look for the ethanol mandate to be reined in the years ahead. As long as the road to the White House starts in Iowa, ethanol will be with the US driving public, but the mega-mandate looks to be in trouble. We remain bullish on oil, with $98 in our sights as an upside objective. We are swimming against the tide with this call, but come on in, the water is fine.

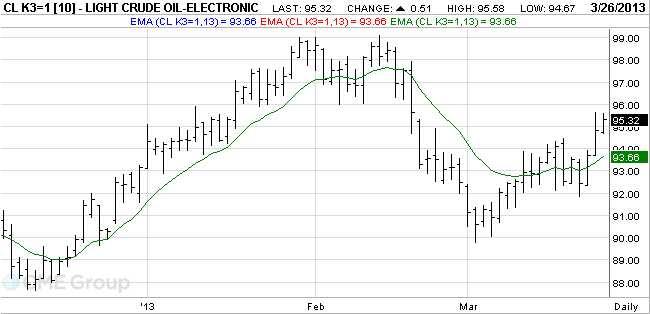

Crude Oil Tech Talk

WTI oil prices are holding the recent gains from the surge above $94.00. In fact, prices begin the day above $95 and appear poised to re-enter the 96-98 congestion from the start of the year. Our view that the primary feature of the chart was a rising wedge patter indicating further gains has come to pass. Prices continue to build upon the uptrend channel from lows in early March. Support is seen at the 13-day EMA at 93.66 and then 92. A break below 92 would set up a rapid sell-off to 90, the area of the March lows.

Natural Gas Market

Prices remain contained by the $4.00 level, and saw some selling last night that pushed prices as low as 3.88. Clearly, the key bullish factor of the late season cold weather is fading. The warmer-than-normal temperatures forecasted for April appear to be emerging as New York City temperatures will approach 60 degrees this weekend. The damage has been done, however. We have chronicled the storage situation, and the consumption numbers are just as stark with gas withdrawals from storage running 39% ahead of last year. The storage report this week should show another withdrawal of 66 bcf, which will add to the year-on-year deficit and impact the dwindling surplus to the five-year average. Thursday may prove to be the rally’s last hurrah. The anticipated withdrawal will get the attention of the market, but the reality of the near-record production in the face of slack demand going forward will weigh on prices rapidly. Prices should rally above $4.00 on more time on the data, which will be a good area to initiate a short sale.

Natural Gas Tech Talk

Prices broke below 3.90 support in overnight trading, and with yesterday’s price action the chart has taken on a bearish tone. There have been three sessions of lower high prices for the day. Prices first broke 3.90 support yesterday, trading in wide-range that appears to have installed a rejection of $4.00. The 3.90 level is pivotal area, increasingly acting as resistance now, prior to the formidable overhead resistance at $4.00. On the downside, support is seen at the 13-day EMA at 3.817, which coincides with the breakout level from several weeks ago. A break of 3.917 area would allow for a rapid sell-off down to 3.65-3.70. The chart has turned bearish, at this point, and the uptrend channel from mid-February is also in jeopardy.

Questions or Comments: [email protected]