ALERT: MORE CENTRAL STIMULUS NEEDED TO STEADY MARKETS

| Contract | Month | Last | Change | BIAS | Comment |

| Crude Oil | August | 85.75 | -1.47 | Neutral | Back of short-covering rally broken. |

| Natural Gas | August | 2.977 | .032 | Higherl | $3.00 breach targets 3.255. |

| S&P 500 | Sept. | 1359.75 | -1.75 | Neutral | Jobs data key to next move. |

| EUR/USD | Sept. | 1.2389 | -.0012 | Lower | Central bank moves come up short. |

Macro View

The response of the markets to not two, but three separate central bank easing efforts (UK, ECB, and China) should give investors pause. While the markets tend to like stimulus, the fact that so much is still needed, after all that has been undertaken, since 2008, is not good news. China cut its main interest rate for the second time, and the UK stepped up with more QE, bith efforts resonated. The ECB, of course, only went so far – no bond purchases for them. The U.S. jobs picture came into focus, yesterday. Curiously, the 376k weekly jobless claims was met with some embrace. That is still a poor reading even if it is sub-400k. The ADP number also showed decent job growth, and some economists raised their job forecasts for this morning. To that, we say: here we go again. The ADP has been a poor predictor of the BLS number. A sub-100k reading should engender another sell-off in equities and oil. Gold will likely come under pressure, as well, but represents a buying opportunity. QE3 awaits.

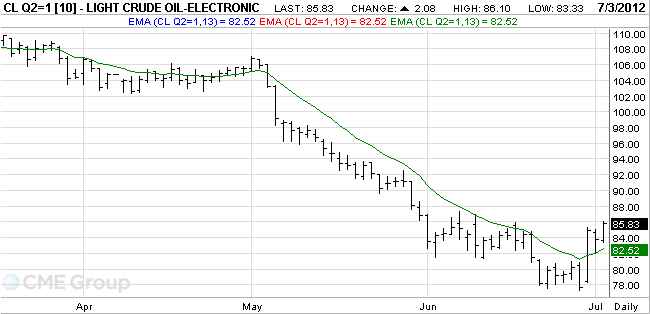

Crude Oil Market

The back of the short-covering rally may be broken, and why not? The global economy is slowing and all macroeconomic data over the last several months have supported that view. Central bank activity that smacks of desperation and an EU Ministers deal that is yet to be detailed seems to have refocused attention on the main headwinds that have been looming over the all markets; slow growth and unacceptably high unemployment. Another disappointing look at this will be available later this morning when US jobs numbers are released. After last month’s Fed meeting Chairman Bernanke seemed to put a lot of emphasis on the faltering employment situation, and the next two months of data as very important in the decision making process by the FOMC in deciding whether or not to embark on a new QE3 program when they meet in August. The market consensus for today’s payroll data is around 125k, with the headline unemployment rate expected to hold steady at 8.2%. A number above consensus may counter-intuitively bring a sell-off as the market interprets it as a lower chance of a new QE program in August. Clearly though, yesterday’s price action implies that the market is not yet convinced that the easy money actions are going to have a material impact on the condition of the global economy in the short to medium term.

Crude Oil Tech Talk

Short covering brought the market right to the limit of profitability of the last leg down. While it appears that short-covering has run its course, there is still upside risk to 92.00. Nevertheless, oil looks to have found very solid resistance by its negative response to what should have been positive news. Still, the rally’s development also suggests that a short term bottom has formed at 77.28. Bias though shifts back to neutral to see if yesterday’s rejection holds through today’s jobs number even though there is risk to the 38.2% retracement of the110.55 to 77.28 move at 89.99. On the downside, any retreat should be contained above the 77.28 low which, if it holds may bring a rebound. Sustained trading that reaches above the 90 psychological level though could possibly usher in a stronger rally towards 114.83, but the probability of that is quite low as such a move would require an exogenous event of considerable import. So a reversal back down remains a strong possibility.

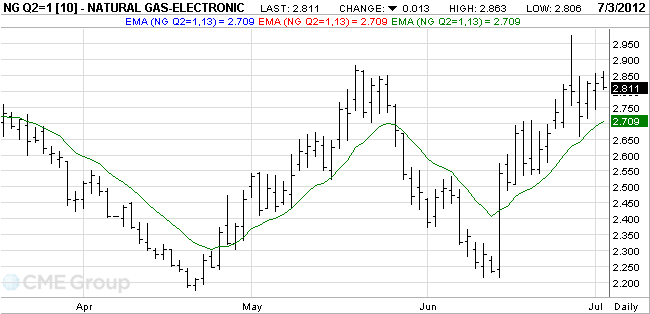

Natural Gas Market

Summer heat keeps gas on an upward path, and forecasters expect more hot weather before a reprieve early next week. But another wave could be coming mid-month. Later this morning, EIA should report another week of injections lagging historic averages reflecting the weather related demand, but below average builds have done little to stifle inventories and there is still an exposure of inventories prematurely hitting maximum storage capacity. Total storage is already 75% full and hovering at a level not normally reached until late August. Government data now projects gas storage to climb to a record 4.015Tcf by the end of October. Still, as prices climb to over 3.00 the coal/gas efficacy, which has lately contributed significantly to demand, begins to diminish making this level hard to sustain. However, recent data from Baker Hughes showed the rig count registering its ninth drop in 10 weeks to its lowest level since August 1999 hinting at a decline in production.

Natural Gas Tech Talk

Gas has breached last week’s high at 2.946 and so far, this session, has extended to over 3.00, posting a high of 3.06 before retreating a bit. But this breach forces a bias for higher, even though it should be difficult to sustain. Any pullbacks should be held to 2.503 support and bring more upside to the 38.2% retracement of the 4.983 to 1.902 move at 3.079 next. Gas may be etching out a longer to intermediate term trend reversal but judgment should be reserved until prices break above 3.255 support turned resistance. As long as this resistance holds, medium term fall from 6.108 is still in favor to continue for a new low below 1.902. However, a break there will indicate that such down trend is finished and stronger rally may be underway. As long as 3.255 resistance holds, the down trend may still in progress.Michael Fitzpatrick

Editor-in-Chief

[email protected]