ALERT: MARKET PARTICIPANTS TAKE A BREATHER

| Contract | Month | Last | Change | BIAS | Comment |

| Crude Oil | September | 84.98 | -.40 | Lower | Poor Fundamentals should keep pressure on despite retracement rally. |

| RBOB – Gasoline | September | 2.9066 | .0029 | Lower | Overall pressure remains, despitecrack spread rally |

| Heating Oil | September | 2.8198 | -.0024 | Lower | Demand readings continue to swing sentiment. |

| Natural Gas | September | 4.014 | -.046 | Lower | Another break of 4.00 should accelerate downside momentum. |

IntroView

This week’s focus will the eurozone debt talk tomorrow, lead by Germany and France. German officials have already warned the markets not to expect much. So, potentially, here we go again. The Consumer Confidence registered its lowest reading since 1980 on Friday, and that is resonanating with the markets. This level of mailaise could easily induce the feared double-dip recession. The markets, however, did not react this number, nor were they rocked by the poor debt auction on Thursday. And Weekly claims did dip below 400k. If Europe can pull something together, last week may be something of a turning point.

Petroleum Market

An extraordinarily volatile week finished on a down note as an early rally off a jump in retail sales was upstaged by consumer confidence data showing that fear the economy is slipping back into recession may prevent further spending. Even as equities ended the week on a positive note, crude oil slid into the week’s end lower for the third consecutive time. However, volume was much lighter than on any other day of the week and price swings were far less violent than those of preceding days. Still, elevated volatility across all major asset classes will most likely continue this week as the debt crisis on either side of the Atlantic, combined with slowing economic activity, still has participants on the edge. Do not forget that the crux of S&P’s downgrade was not the inability of the US to pay its debts, but rather, based on policymakers inability to address the crisis in a substantive way. The same goes for Europe, creating a mind-set that has now driven the Swiss franc to ridiculously overvalued levels. The problems are not going away just because stock markets appear to have stabilized for a couple of days. OPEC, so far, has en quiet about a production response to falling prices. A sustained break below $80.00 should provoke a response.

Petroleum Tech Talk

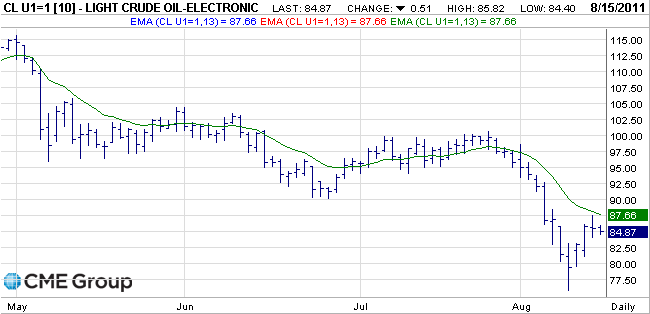

From July 26th to August 9th, only two weeks, oil prices dropped almost $25.00. It only took three days, Wednesday, Thursday and Friday, last week to take back almost $12.00. Even still, prices remain below their respective 13-unit EMAs on daily, weekly and monthly charts. The degree of the slope down could clearly not be sustained and the mid-point of the initial slide is 88.16; current momentum could easily carry the market there. Open interest declined during the steepest part of the decline. A good portion of that may be attributed to natural migration to the October contract prior to expiration next week. Taking that into account there was still a net 10% drop in open interest, showing that longs were throwing in the towel and shorts were covering. The counter-trend rally could continue to the 88.00-91.00 area before resuming.

Natural Gas Market

With the thermometer closer to seasonal norms, excepting Texas and parts of the Southwest, it should hardly surprise that Friday’s activity could not best Thursday’s high, posted after the unexpectedly paltry rise in stocks of only 25 bcf. This puts the ongoing imbalances consequent to record high production and a weak economy center stage; ergo, more selling pressure should ensue, setting up another test of 3.80. Still, National Hurricane Center is monitoring four low pressure systems in the Atlantic Ocean. While none look like a serious threat to Gulf installations, they will serve as bleak reminders, only six years on from Katrina, that the peak of the storm season in late August and September is near. Baker Hughes offered more directional help, issuing on Friday its weekly rig count, posting a five-month high at 896. So, without a major storm or another heat wave to stir up demand, skepticism should grow about any upside movement in the immediate future.

|

Natural Gas Tech Talk

Natural gas edged lower to 3.855 last week but formed a short term bottom there and recovered. The overall bias must remain to the downside after that recovery fizzled out on Friday. Any rally should be limited by 4.23 resistance and usher in more selling. A settlement below 4.00 will embolden sellers to push beyond 3.855, which is now minor support. A break there will project 3.692 as a reflection of the move down earlier from 4.983 to 4.064. An upside move through first resistance at 4.23 will turn focus back to 4.612 instead. There is a small opening gap below the 13-day EMA and today’s pivot of 4.084 which highlights the market’s inherent weakness.

Written by: Michael Fitzpatrick

Michael Fitzpatrick, Editor-in-Chief

[email protected]