ALERT: ECONOMC STRENGTH UNDENIABLE AS DATA FLOW IN

| Contract | Month | Last | Change | BIAS | Comment |

| Crude Oil | January | 97.35 | .15 | Higher | Market breaks out to the upside. |

| Natural Gas | January | 3.996 | .036 | Higher | Early season cold weather sufficient to spark and sustain rally. |

| S&P 500 | December | 1791.45 | -0.35 | Higher | Equity rally powers on due to easy Fed outlook. |

| EUR/USD | November | 1.3546 | -.0046 | Lower | Euro zone deflation scare hits currency. |

MACRO VIEW

The economic data out yesterday was mostly great. The ADP report showed 215k new private sector jobs were created last month, and new home sales jumped 25% for the same period. The Fed’s Beige Book reported middling results, but was still net positive. Today’s data is no less great: the second look at Q3 GDP showed a rise to 3.6%, thanks mostly to inventory adjustments. Exports of refined oil products is part of the solid number, and the rise of this export industry has gone largely unheralded. Weekly jobless claims also confirmed the strong employment trend, of late, with the fall below 300k to 298k, and it points the way toward a 250K-plus jobs report tomorrow. The equity market rally has taken a pause, as the data are certainly nearing a point where the Fed should be comfortable pulling the trigger on tapering. The UK and European Central Banks meet, today, and the commentary associated with their rate decision will need to be parsed. The UK’s Chancellor of the Exchequer made an interesting observation in upping his forecast of UK GDP from 0.6% to 1.3% for 2013 and 2.4% for 2014: “we have held our nerve while those who predicted there would be no growth until we turned on the spending taps back on have been proven comprehensively wrong.” Given the extent of cuts in the US government, which has shrunk to its smallest size since the Clinton Administration, especially from the sequestration, a similar crow could be made here. However, one could also ask where the growth rates would be, if the spending taps were opened up, along with the natural recovery of the economy. Discuss among yourselves. The equity market pause is clearly due to concerns over a possible or even likely reduction in Fed easing. The data are good enough to offset those, which was the Fed’s plan all along. The rally should keep going. Finally, on a separate note: German spot power prices are down nearly 20% because several storms ripping across the Continent are generating so much wind power. We focus a lot on the weather and its effect on natural gas prices. It will be even more fun if the US can get enough installed wind capacity where our wind storms affect prices. Here’s to the future!

CRUDE OIL

The Brent-WTI spread has whipped around so much, lately, that it may be the latest “safe” spread trade to take on the “widow maker” moniker. Yesterday, it narrowed by more than $2.00 per barrel, feeding off the weekly US inventory report, which showed a 5.6 million barrel decline. This, of course, punctuated the news of the start of the Keystone pipeline southern leg and the even larger decline in US inventories reported by the API on Tuesday. The report also showed a sizeable rise in East Coast refining activity, which rose 8.1% to 84.3%. That supported Brent for a while, yesterday, but it served to further highlight the growing demand for crude oil, overall, in the US, as the refining ticks up. The advantage US refiners have over their European counterparts continues to be exploited. More and more cheap shale oil is riding the rails to the East Coast. Hurting Brent, yesterday, relative to WTI was the between-the-lines read of OPEC’s decision to rollover its output scheme. They are not scheduled to meet again until June, but market forces are likely to cause the meet sooner than that. The commitment to increase production by Iraq and Iran was remarkable. Iran even published a list of seven oil majors that it wants to come and work on its oilfields, including ExxonMobil and ConocoPhillips. It’s hard to tell who will the prize for making the most remarkable statements of 2013 – President Rouhani and company or the Pope. The rally in WTI is continuing, and, beyond the fundamentals of the reordering of the pipeline infrastructure and the increased demand from the uptick in refining activity, the economic data, especially improvement in employment, is supportive for now. The rally should carry into year-end and the beginning of next, as new money chases the uptrend. The falloff in demand in mid-to-late January will provide a reality check and pullback in prices, once again. Although, the impact on Cushing supplies from the Keystone initiation will counter the bearish refined product demand falloff.

CRUDE OIL TECH TALK

Prices are beginning to consolidate at the new higher level, after the breakout higher, earlier in the week. 97 is now support, with 98 as nearby resistance. The size of the daily price bar from Tuesday makes the rally vulnerable to a significant pullback, if 97 is breached. Support is not seen until 95.60 and the 13-day EMA at 95.07. 98 is mild resistance, and a move above that mark will open up a run toward 100 fairly quickly. The recent low at 91.80 is proving to be the near-term bottom that we correctly identified. More upside appears likely, and the reversal signal is worth following. If you want to get in here, use 96.20 as a stop-loss.

NATURAL GAS

Natural gas prices took another run above $4.00, again yesterday, but they failed to hold, closing lower for the second day. The four-handle is proving just too much of an allure for sellers. The weather outlook is surely supportive, and the secondary effect of the current winter weather blast will be more cold weather and storms, as the ground freeze affects the atmosphere. The extended forecasts continue to show below normal temperatures, but they may not be enough to sustain the $4.00 mark. Today’s inventory report will hold the key to maintaining $4.00 in the near-term. We are looking for a withdrawal of 131 bcf, while the average of the analyst survey is 138. Recounting the historical withdrawal data, last year saw a 62 bcf withdrawal and the five-year average is a mere 41 bcf. Obviously, if the estimates are correct or end up representing “the under,” prices will soar higher again. The report will likely produce a significant bullish reaction and lurch higher. That has been the recent trend, and, if you have a quick finger, it is probably worth selling into the immediate aftermath. Prices will, however, likely finish the day above $4.00, due to the report. The uptrend has stalled, for the moment, but the fundamental data point hitting up later today should restore the vigor of the bulls. The Commitment of Traders report will be telling, in terms of the sustainability of the run. Look for that, tomorrow afternoon. More upside, with some ups and downs, appears likely.

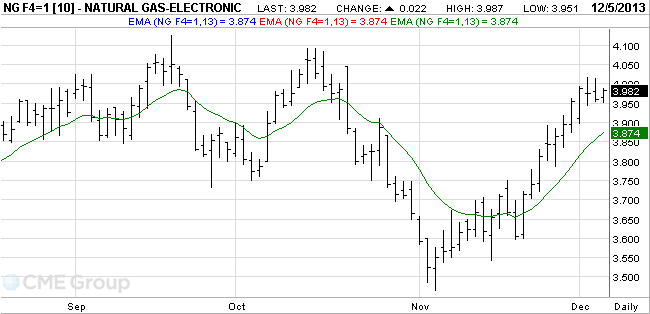

NATURAL GAS TECH TALK

It is too premature to call the uptrend over, but yesterday produced a lower-high. It also produced a higher low, however, so the chart, with today’s early action, is producing a pause for the moment. The nascent sideways action will help to alleviate the overbought condition of the rally, so that actually helps the bulls. Prices appear ready to make another run at 4.00, and the third run should open up a move to the October high at 4.09 in short order. If prices reach the 4.10 upside objective, then a tactical shorting opportunity will exist. Support is seen at 3.951 and 3.92. Below that, support is seen at the 13-day EMA at 3.874. The uptrend remains intact, overall. Stay with the trend.

Questions or Comments: [email protected]